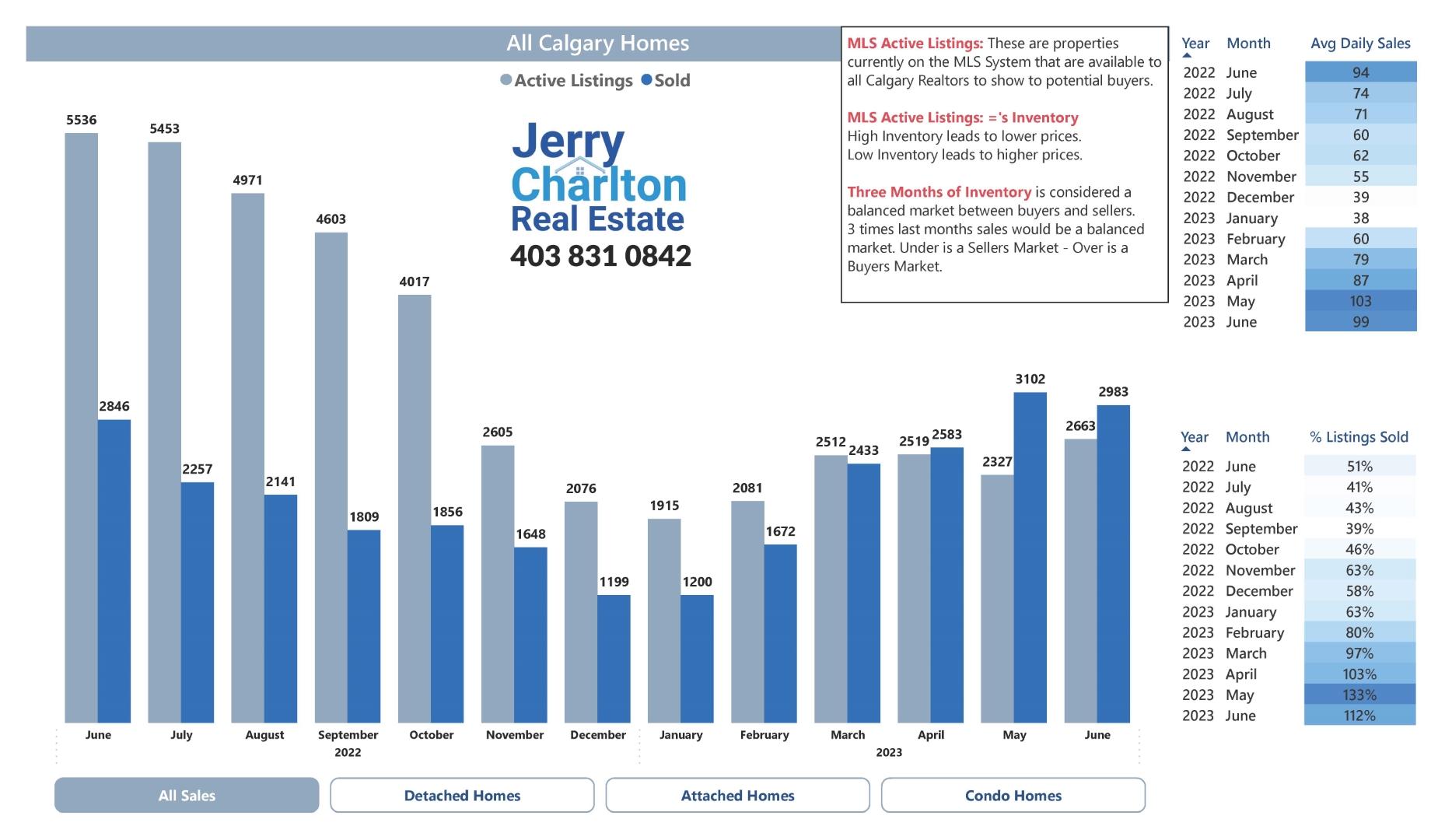

June 2023 Calgary Real Estate Stats

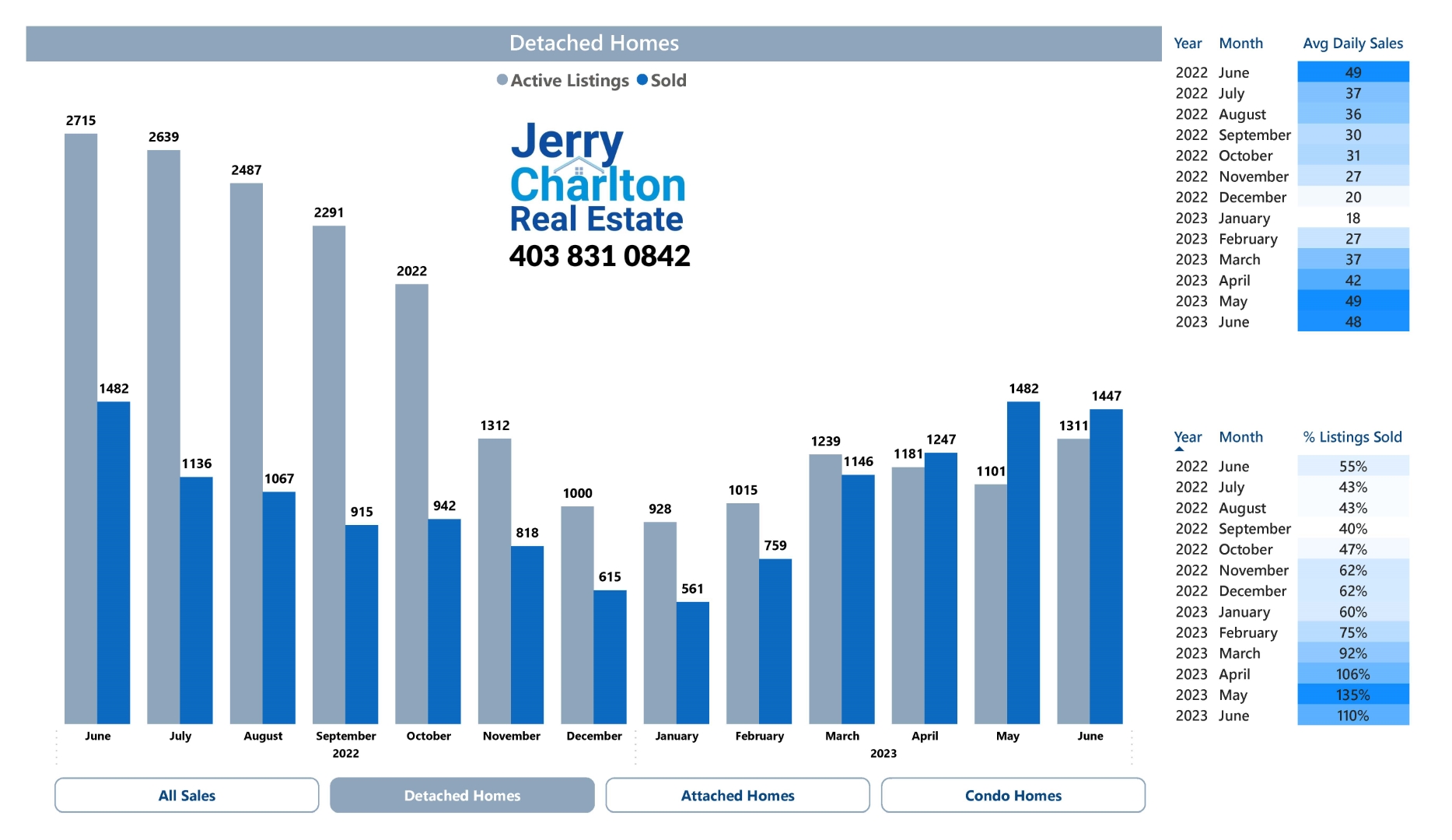

Sellers Market remains strong in Calgary. Buyers are bidding prices higher as they fight for a home in Calgary’s low inventory housing market.

Mortgage fine print concerning mortgage portability and payout penalties could help with the low inventory situation. Lots of would-be sellers are anchored to the mortgage, not the house. They would move in a heartbeat if they could take their low-interest rate mortgage with them without predatory bank strings attached.

Banks are predatory by nature. We all know that. However, they could put a lot of homes on the market with some simple mortgage rule changes.

No Strings Attached Portability. No Payout Penalties Ever. CMHC Insurance stays with the Buyer, not the Mortgage.

June 2022 had 5,336 homes for buyers to choose from. This June, there is about half that amount at 2,663. Sales are slightly up, but not as big a difference as the active listings.

Higher Calgary Mortgage Interest Rates are having no effect on home buyers. Higher Calgary Mortgage Rates are keeping sellers sitting on their hands.

Next month will be different, but not by much.