Single Family Detached Home Prices

in Calgary Since 1968

In 1968 Calgary, there were no condos and very few townhomes. Single-family detached homes were the benchmark then, so we have excluded condos and townhomes in this story.

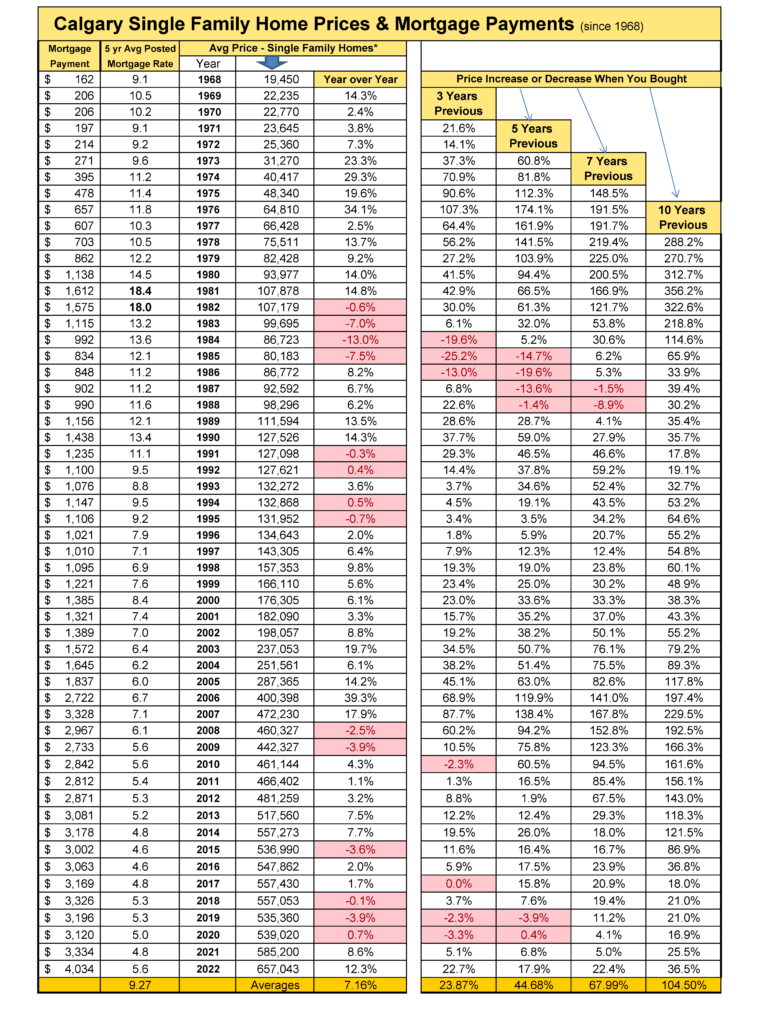

The chart below tells quite a few interesting stories about the Calgary Real Estate Market. Like, what would the average monthly mortgage payment be based on the average home price and 5-year fixed mortgage rate? The monthly payments for 1981 and 2004 are pretty close, even though the price of a home in 1981 was $107,000 vs $251,000 in 2004.

1981 and 1982 are the years old people talk about. Those are the years people walked away from their mortgages for one dollar. Looking back, all they had to do was hang on for five years. In that time, their home dropped in value by over 20%. However, the monthly mortgage dropped by 50%. Would you be ok with that?

Very few people move after the first year of owning a home. Very few people take less than a five-year fixed mortgage. Most people see the value of the home go up as the mortgage debt goes down. This applies to single-family detached homes in Calgary.

The one-year average increase in homes since 1968 stands at 7.16% right now. The average increase over 3 years of ownership since 1968 is close to 24%. The average over a 10-year period is 104%.

These are actual numbers – no projections. Future projections are up to you.

20 years ago, I started this chart. Right after I got my Realtors® license. I wanted to invest in Real Estate and I wanted to prove to myself that it was a worthwhile investment.

Investment Real Estate you can buy with debt and a small bit of your own money. Then you can have someone else pay off the debt for you. The odds of making a decent investment increase with the type of property you buy and the time you own it.

Look at this chart – I bought two single-family rental properties in Sept of 2007. I still own one today with a small mortgage left. The only money I put into it out of my pocket was in 2007. At the time, I was very nervous as the world financial crisis was happening. My stock market investments in blue chip companies were almost wiped out. Everybody dumps the best stocks in a crash because those are the only ones that people will buy. Crazy times with lots to learn. The other house I renovated, but couldn’t sell it at a profit right away. So I got a great tenant and sold for a profit later. I tell people that I would have no money to lose in the stock market if it weren’t for my real estate investments.

Fast forward to today. Nobody can predict the future accurately. I do, however, predict that in the next 20 years, single-family detached homes will be a great place to invest. Try to buy low, so you start with a cushion to make you feel better. Buy when you are young is the best strategy of all.

Here’s the basic formula. You put in 20%, the bank puts up 80%, and the tenant pays off the bank, leaving you with 100% of the property and the bank with 0%. You turned 20% into 100%.

Real Estate Investing 123

- Buy the right type of property at the right price.

- Keep it for a long time

- Repeat

Not everybody can buy investment properties on their own. Put your business plan together and find a partner or two. Lots of people would like to invest in real estate without doing any work. Find those people.

can make you happy!

Work with an experienced Realtor® and Mortgage Agent to find and finance the right properties.

Professionally manage the properties yourself or contract that part out.

Repeat….

Time In The Market is More Important than Timing the Market

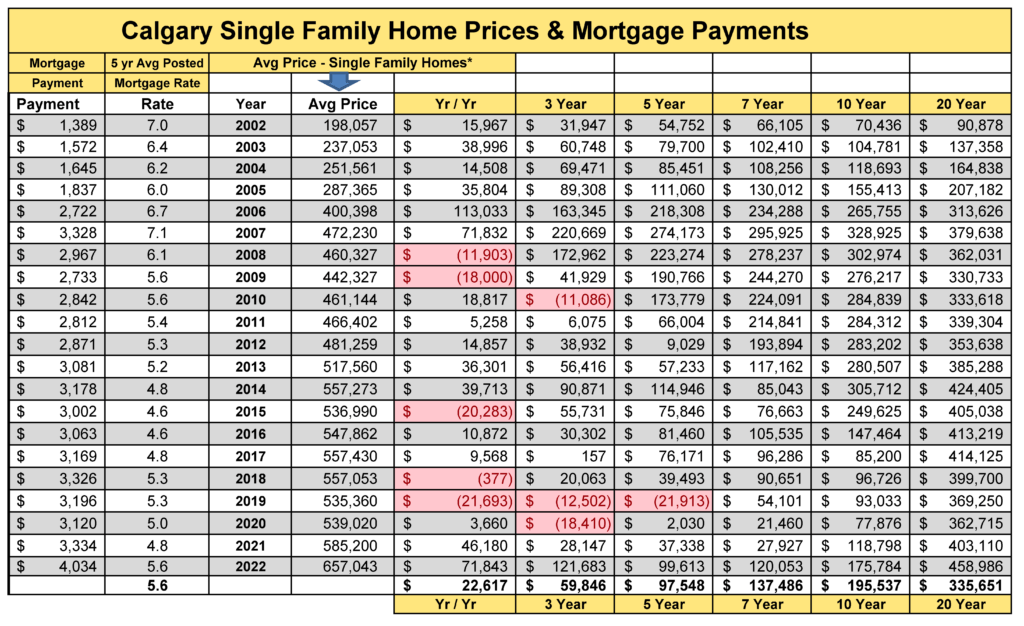

This chart shows the last 20 years by dollar differences. A few more interesting stories of winners and losers.

Your key takeaway should be that in the long term, everything will be alright.